Current Market.

Central Texas housing market posts largest gain in closed sales in 2025

Renewed buyer confidence and steady prices mark a healthy, seasonal market

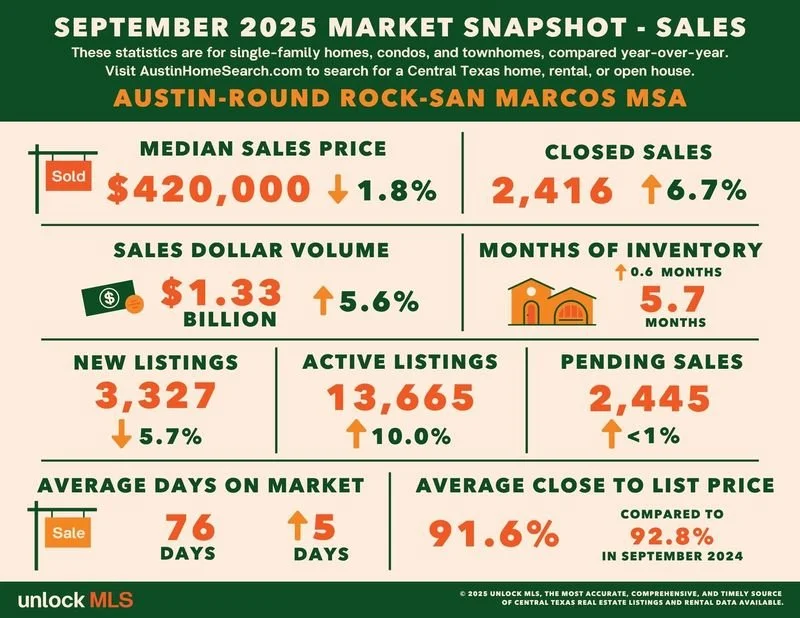

AUSTIN, Texas — According to the September Central Texas Housing Report released by Unlock MLS, closed sales rose 6.7% year over year to 2,416 sales in the Austin-Round Rock-San Marcos MSA, ending the third quarter with its strongest sales growth of 2025. Coupled with a 1.8% decrease in the median sales price to $420,000, the data reflects sustained activity through late summer and early fall, pointing to renewed buyer confidence and continued market balance as prices follow typical seasonality.

Vaike O’Grady, research advisor at Unlock MLS, mentioned that September’s data reflects a stable market that continues to align with expectations.

“The numbers we’re seeing in September match the trends we expected to see this time of year. As we wrap up the third quarter, the market is mirroring typical seasonality trends, pointing to a sign of continued adjustment and balance. Buyer enthusiasm has picked up slightly as we saw the first interest rate cut in nine months, and steady pricing from sellers continues to support that confidence. What we’re seeing in the market now is a healthy level of stability. Homes may be taking a bit longer to sell, but they’re still selling, and buyers are meeting sellers where they are. This consistency shows that the market is functioning as it should—steady, sustainable and well-positioned heading into the end of the year.”

Brandy Wuensch, 2025 Unlock MLS and ABoR president, added that this stability also reinforces the value of having a trusted real estate professional to help buyers and sellers navigate the full picture of homeownership.

“Homeownership involves a range of costs—from property taxes and insurance to ongoing maintenance—and REALTORS® help buyers understand that complete picture. Our role is to guide people toward decisions that support their long-term homeownership goals by giving them the knowledge and resources they need to navigate the process with confidence.”Austin-Round Rock-San Marcos MSA

September 2025 - For Sale

2,416 – Residential homes sold, 6.7% more than September 2024.

$420,000 – Median price for residential homes, 1.8% less than September 2024.

3,327 – New home listings on the market, 5.7% less than September 2024.

13,665 – Active home listings on the market, 10.0% more than September 2024.

2,445 – Pending sales, 0.3% more than September 2024.

5.7 – Months of inventory, 0.6 months more than September 2024.

$1,334,701,789 – Total dollar volume of homes sold, 5.6% more than September 2024.

91.6% – Average close to list price, compared to 92.8% in September 2024.

September 2025 - For Lease

1,951 – Closed leases, 6.9% less than September 2024.

$2,200– Median price for rent, flat compared to September 2024.

2,723 – New lease listings on the market, 9.3% more than September 2024.

5,919 – Active lease listings on the market, 2.8% more than September 2024.

2,125 – Pending leases, 4.5% more than September 2024.

3.0 – Months of inventory, 0.4 months more than September 2024.

$4,949,723 – Total dollar volume of leases, 3.4% less than September 2024.

95.0% – Average close to list price, compared to 94.2% in September 2024.

-

September 2025 - For Sale

837 – Residential homes sold, 16.6% more than September 2024.

$550,000 – Median price for residential homes, 6.0% less than September 2024.

1,271 – New home listings on the market, 0.8% more than September 2024.

4,915 – Active home listings on the market, 6.7% more than September 2024.

835 – Pending sales, 7.7% more than September 2024.

5.9 – Months of inventory, 0.3 months more than September 2024.

$610,185,636 – Total dollar volume of homes sold, 14.0% more than September 2024.

90.9% – Average close to list price, compared to 92.0% in September 2024.

September 2025 - For Lease

949 – Closed leases, 12.5% less than September 2024.

$2,495 – Median price for rent, 6.2% more than September 2024.

1,383 – New lease listings on the market, 15.1% more than September 2024.

2,887 – Active lease listings on the market, 2.3% more than September 2024.

1,001 – Pending leases, 1.4% less than September 2024.

2.7 – Months of inventory, 0.1 months less than September 2024.

$2,732,151 – Total dollar volume of leases, 5.9% less than September 2024.

95.0% – Average close to list price, compared to 93.6% in September 2024.

-

September 2025 - For Sale

1,065 – Residential homes sold, 9.5% more than September 2024.

$485,000 – Median price for residential homes, 3.6% less than September 2024.

1,674 – New home listings on the market, 0.8% less than September 2024.

6,635 – Active home listings on the market, 8.1% more than September 2024.

1,113 – Pending sales, 6.4% more than September 2024.

6.1 – Months of inventory, 0.3 months more than September 2024.

$714,900,142 – Total dollar volume of homes sold, 7.2% more than September 2024.

91.0% – Average close to list price, compared to 92.2% in September 2024.

September 2025 - For Lease

1,092 – Closed leases, 9.5% less than September 2024.

$2,400 – Median price for rent, flat compared to September 2024.

1,579 – New lease listings on the market, 8.6% less than September 2024.

3,362 – Active lease listings on the market, 1.3% more than September 2024.

1,143 – Pending leases, 0.3% more than September 2024.

2.8 – Months of inventory, flat compared to September 2024.

$3,054,212 – Total dollar volume of leases, 3.9% less than September 2024.

95.1% – Average close to list price, compared to 93.9% in September 2024.

-

September 2025 - For Sale

808 – Residential homes sold, 5.9% more than September 2024.

$406,722 – Median price for residential homes, 2.8% less than September 2024.

977 – New home listings on the market, 8.3% less than September 2024.

4,301– Active home listings on the market, 18.8% more than September 2024.

843 – Pending sales, 4.3% less than September 2024.

5.5 – Months of inventory, 1.3 months more than September 2024.

$379,998,760 – Total dollar volume of homes sold, 4.7% more than September 2024.

92.2% – Average close to list price, compared to 93.3% in September 2024.

September 2025 - For Lease

653 – Closed leases, 2.7% less than September 2024.

$2,100 – Median price for rent, flat compared to September 2024.

849 – New lease listings on the market, 6.7% more than September 2024.

1,877 – Active lease listings on the market, 4.9% more than September 2024.

752 – Pending leases, 9.6% more than September 2024.

2.3 – Months of inventory, 0.2 months more than September 2024.

$1,450,445 – Total dollar volume of leases, 0.9% less than September 2024.

94.7% – Average close to list price, compared to 94.5% in September 2024.

-

September 2025 - For Sale

392– Residential homes sold, 3.7% more than September 2024.

$360,000 – Median price for residential homes, 2.6% less than September 2024.

429 – New home listings on the market, 15.6% less than September 2024.

1,763 – Active home listings on the market, 2.9% less than September 2024.

348 – Pending sales, 6.5% less than September 2024.

4.6 – Months of inventory, 0.1 months less than September 2024.

$181,191,743 – Total dollar volume of homes sold, 1.0% more than September 2024.

92.2% – Average close to list price, compared to 92.7% in September 2024.

September 2025 - For Lease

158 – Closed leases, 4.2% less than September 2024.

$2,049 – Median price for rent, 2.4% less than September 2024.

239 – New lease listings on the market, 1.3% more than September 2024.

535 – Active lease listings on the market, 3.5% more than September 2024.

184 – Pending leases, 17.2% more than September 2024.

2.7 – Months of inventory, flat compared to September 2024.

$351,872 – Total dollar volume of leases, 4.3% less than September 2024.

95.2% – Average close to list price, compared to 93.4% in September 2024.

-

September 2025 - For Sale

100 – Residential homes sold, 15.3% less than September 2024.

$350,000 – Median price for residential homes, 1.9% less than September 2024.

190 – New home listings on the market, 4.4% more than September 2024.

791 – Active home listings on the market, 13.6% more than September 2024.

114 – Pending sales, 11.8% more than September 2024.

7.5 – Months of inventory, 1.0 months more than September 2024.

$48,693,026 – Total dollar volume of homes sold, 25.7% more than September 2024.

91.7% – Average close to list price, compared to 94.1% in September 2024.

September 2025 - For Lease

41 – Closed leases, 20.6% more than September 2024.

$1,925 – Median price for rent, 8.3% less than September 2024.

40 – New lease listings on the market, 7.0% less than September 2024.

110 – Active lease listings on the market, 2.8% more than September 2024.

30 – Pending leases, 23.1% less than September 2024.

3.0 – Months of inventory, 0.1 months less than September 2024.

$68,789 – Total dollar volume of leases, 26.4% less than September 2024.

96.1% – Average close to list price, compared to 98.8% in September 2024.

-

September 2025 - For Sale

35 – Residential homes sold, 31.4% less than September 2024.

$303,790– Median price for residential homes, 7.2% more than September 2024.

57 – New home listings on the market, 1.8% more than September 2024.

176 – Active home listings on the market, 13.5% more than September 2024.

28 – Pending sales, 22.2% less than September 2024.

5.2 – Months of inventory, 1.5 months more than September 2024.

$11,588,840 – Total dollar volume of homes sold, 26.8% less than September 2024.

90.5% – Average close to list price, compared to 93.8% in September 2024.

September 2025 - For Lease

14 – Closed leases, 16.7% more than September 2024.

$1,800 – Median price for rent, 12.5% more than September 2024.

16 – New lease listings on the market, flat compared to September 2024.

35 – Active lease listings on the market, 34.6% more than September 2024.

16 – Pending leases, 45.5% more than September 2024.

2.4 – Months of inventory, 0.6 months more than September 2024.

$24,405 – Total dollar volume of leases, 21.5% more than September 2024.

96.5% – Average close to list price, compared to 94.6% in September 2024.